With over 20 years of experience and knowledge we provide our buyers and real estate investors More Than Just a Home! Whether you are a first-time home buyer in Utah or an experienced real estate investor, we have a no up-front cost and no obligation program for you. We understand that buying a property can be very stressful and sometimes emotional. Let us do all of the heavy lifting throughout your home buying process by searching for home-buyer financial assistance programs in your area and help you find an under-market value deal. Invest with confidence and experience real results when you buy a property or invest with us.

|

Bad Credit!

No Problem

Loan Denied!

No Problem

100% Financing!

No Problem

Self Employed!

No Problem

No Cost Services!

Yes

Buy Discounted Properties!

Yes

Buy Cash Flowing Properties!

Yes

Short Term Rentals!

Yes

Renovation Services!

Yes

Private Money !

Yes

|

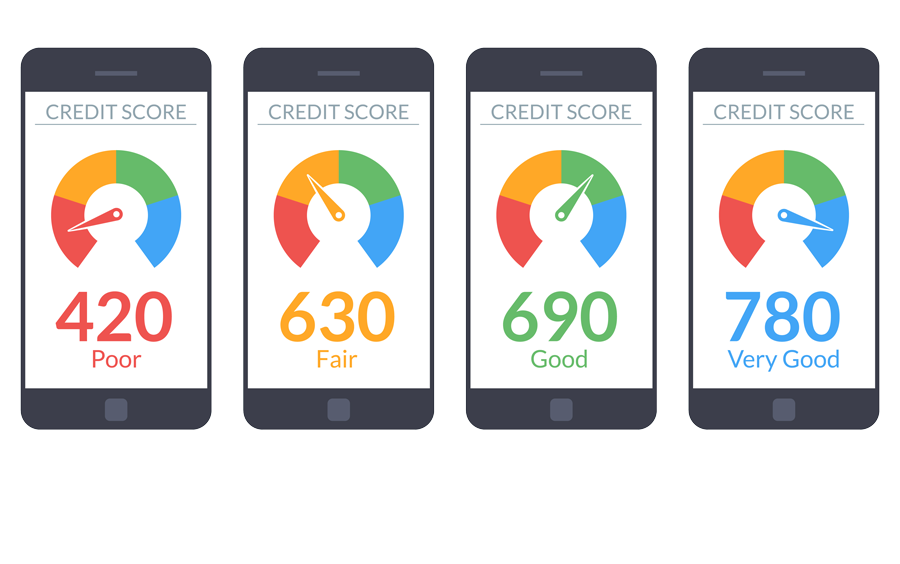

Before you start looking for a property on the Utah Multiple Listing Service (MLS), the first thing you need to know is your credit score and history. Credit is one of the most important factors a mortgage lender looks at when determining if they will approve your loan. We have third party vendors who specialize in credit enhancement and repair. The credit enhancement and repair companies that we associate with can usually increase your credit score by 60 to 100 points within a 2 to 3-week timeline. The credit repair associates can also remove derogatory credit history from your credit report if necessary. You can get a free copy of your credit report once a year at www.annualcreditreport.com or get a free copy of your credit reports and credit scores from all three credit bureaus at www.creditsesame.com or www.creditkarma.com.

Before we set up an appointment to view a property, a loan officer will need to determine how much of a mortgage payment you can afford. Once a loan officer has received and reviewed a copy of your free credit report and all of your financial documents, the loan officer will provide you a buyer pre-approval letter. A buyer pre-approval letter means that a loan officer has looked at your credit report, verified your income and your down payment, and has determined that you have met the requirements to apply for a certain loan. We have an extensive list of loan officer affiliates and buyer programs that can basically overcome all buyer obstacles. If you have been denied a loan, there is a very good chance that we can find a lending program or affiliate that can get you approved. We will never give up on our clients and we enjoy watching our clients succeed.

It’s imperative that you work with an experienced and knowledgeable real estate agent in order to purchase a property in Utah. We don’t charge our buyers any out-of-pocket expenses for our services. The buyer agent commission is paid by the seller if the home is listed on the MLS (multiple listing service). Some buyers think that they can negotiate a lower purchase price if they don’t use a buyer agent, however this is usually not true as the seller is still obligated to pay the full commission to the seller’s agent. Not having the proper representation could end up costing you more money if you choose to go through a real estate transaction on your own. For whatever reason if you decide to not work with us, we ask that you use another licensed REALTOR® to assist in the home buying process.